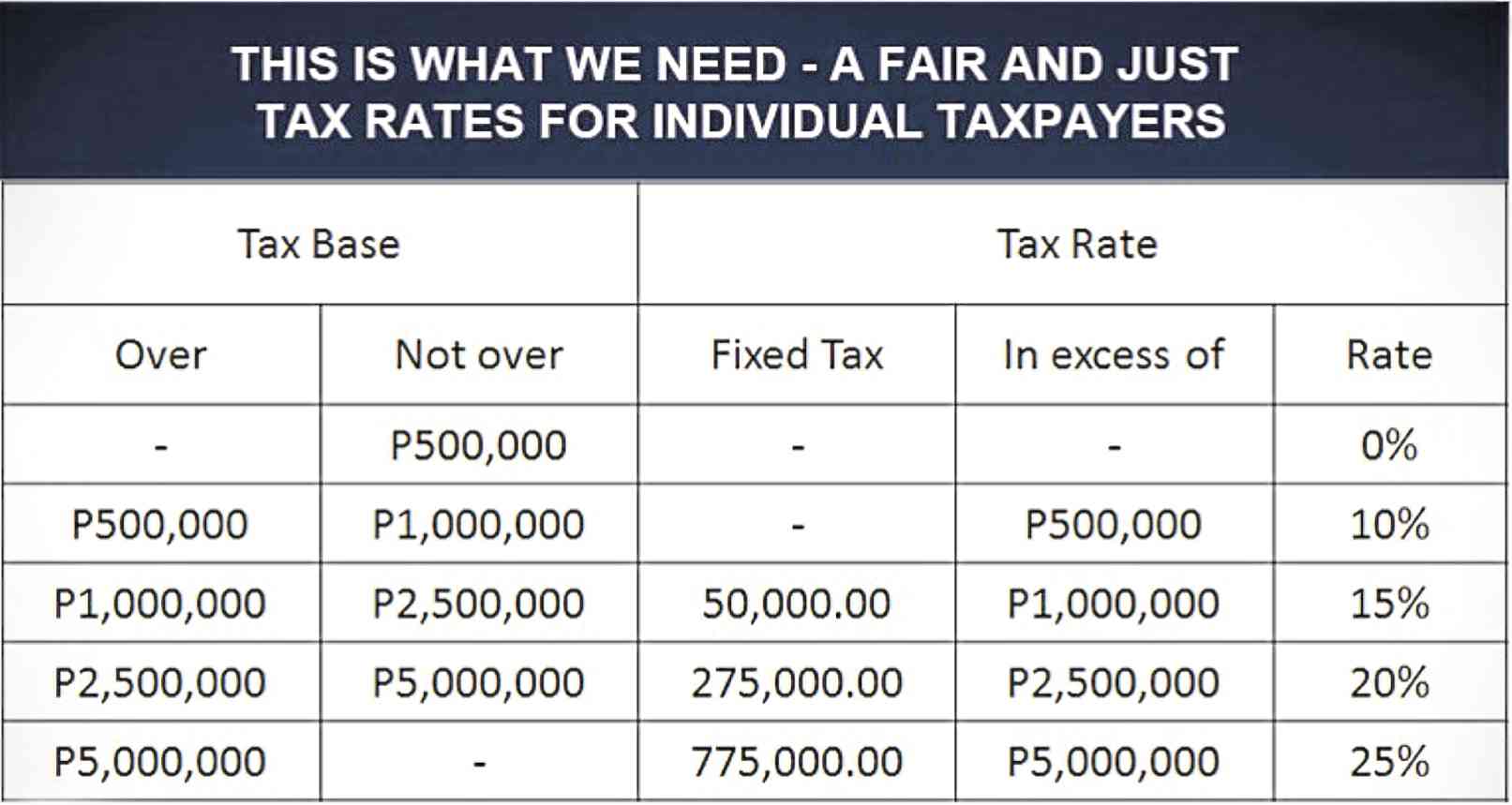

Tax Calculator 2025 Philippines

BlogTax Calculator 2025 Philippines - ₱190.26k Salary After Tax in Philippines PH Tax 2025, That means that your net pay will be ₱ 191,183 per year, or ₱ 15,932 per month. Know how much of your salary you'll be taking home with the new tax reform policy. Philippine Tax Bracket 2025 Gerti Petronella, The philippines tax calculator below is for the 2025 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in philippines. Learn how to estimate your income tax with easy steps focusing on taxable income and understanding the results.

₱190.26k Salary After Tax in Philippines PH Tax 2025, That means that your net pay will be ₱ 191,183 per year, or ₱ 15,932 per month. Know how much of your salary you'll be taking home with the new tax reform policy.

Tax Computation Philippines 2025 Suzi Shanta, For inquiries or suggestions on the. Your average tax rate is 5.4% and your marginal tax rate is 2.0%.

₱70k Salary After Tax in Philippines PH Tax 2025, Avoid underpaying or overpaying your taxes and save yourself from the process of settling penalties and refunds. Calculate you daily salary after tax using the online philippines tax calculator, updated with the 2025 income tax rates in philippines.

₱325.26k Salary After Tax in Philippines PH Tax 2025, In 2025, the deductions for. Calculate your income tax, social security.

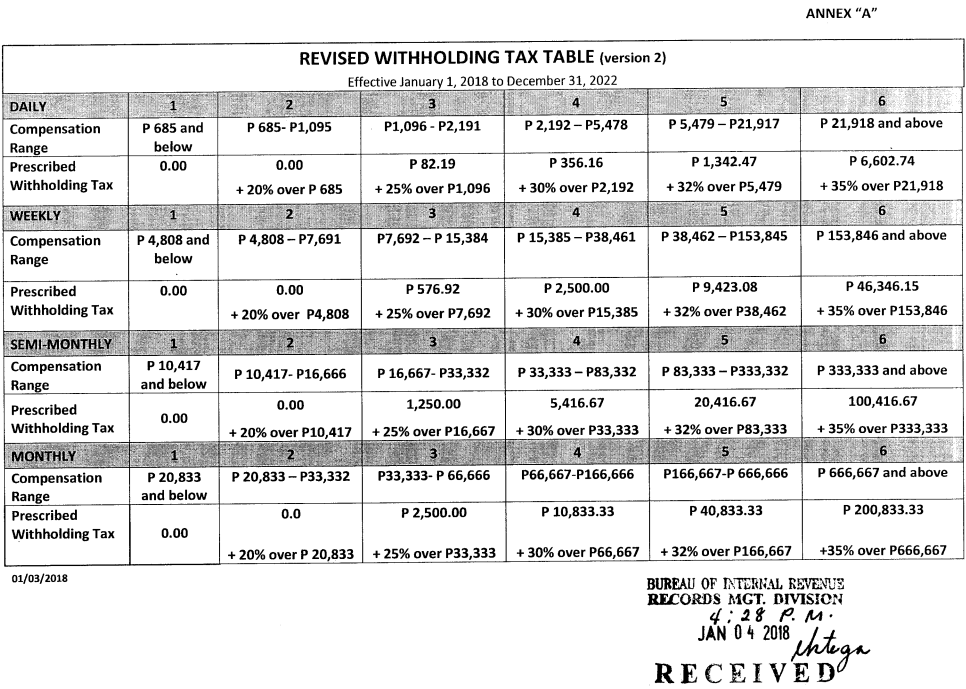

Tax Calculator 2025 Philippines Semi Monthly Delora Kendre, Know how much of your salary you'll be taking home with the new tax reform policy. Follow these simple steps along with a sample scenario to navigate the process:

Your average tax rate is 5.4% and your marginal tax rate is 2.0%.

Philippines Monthly Tax Calculator 2025 Monthly Salary After Tax, Identify all income sources, such as salary, bonuses, and. For inquiries or suggestions on the.

Make your tax filing a whole lot easier with a tax calculator for philippine tax forms. Identify all income sources, such as salary, bonuses, and.

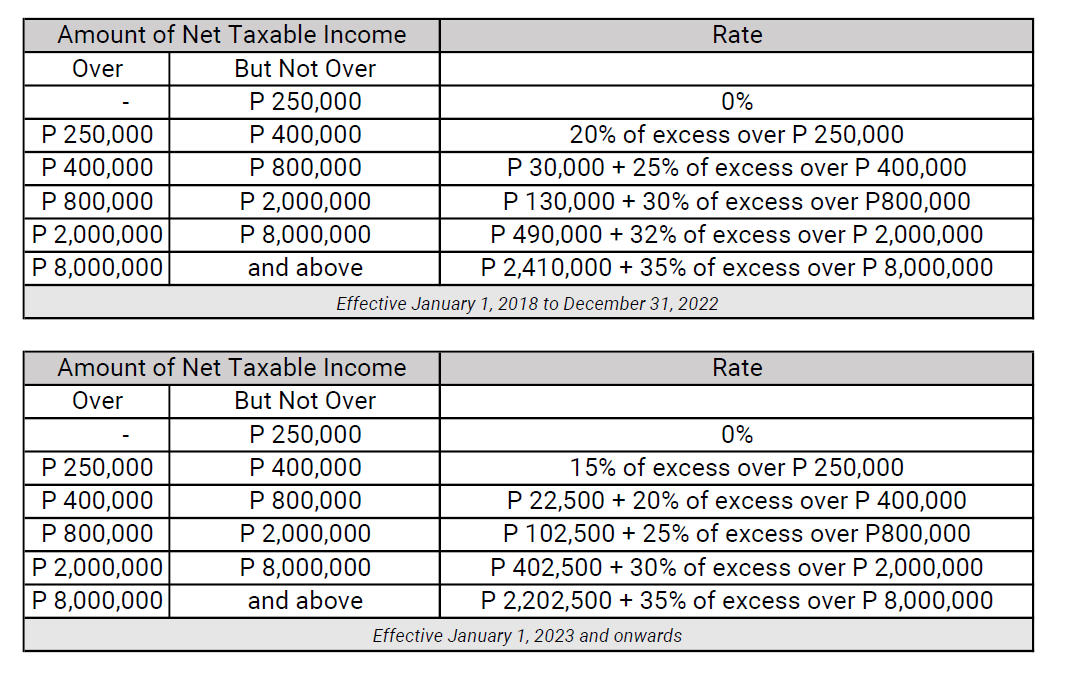

This train law tax calculator automatically computes your.

Tax Calculator 2025 Philippines. The free online 2025 income tax calculator for philippines. Just enter your gross income and the tool quickly calculates your net pay after taxes and.

2025 2025 Tax Calculator Estimate Esme Cecilla, Pakistan’s tax authority said on thursday it has blocked 210,000 sim cards of users who have not filed tax returns in a bid to widen the revenue bracket. In 2025, the deductions for.